技术分析,机器学习,价格行动,回溯测试,MetaTrader 5现场交易。

你会学到什么

创建一个从A到Z的算法交易策略(数据导入到实时交易)

使用MetaTrader 5和Python将任何算法放入实时交易中

使用Pandas清理数据

guided·图尔认为主要的算法交易策略(技术分析、价格行动、机器学习)

使用Numpy、Pandas和Matplotlib管理财务数据

算法交易的Python编程

创建缩放、日内和波动交易策略

从雅虎财经和你的经纪人那里导入股票价格

MP4 |视频:h264,1280×720 |音频:AAC,44.1 KHz,2声道

语言:英语+中英文字幕(云桥CG资源站 机译) |时长:79节课(6小时17分钟)|大小解压后:2.67 GB

要求

没有任何东西

描述

你想创建算法交易策略吗?

你已经有了一些交易知识,还想学习量化交易/金融?

你只是一个好奇的人,想进入这个主题来赚钱和丰富你的知识?

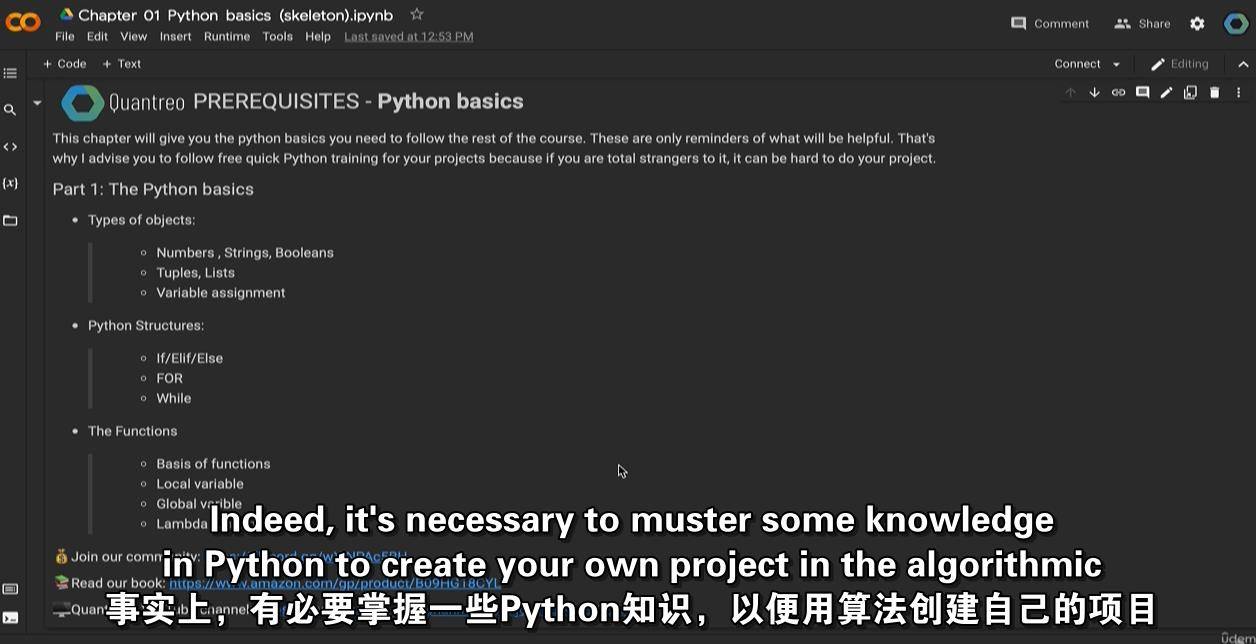

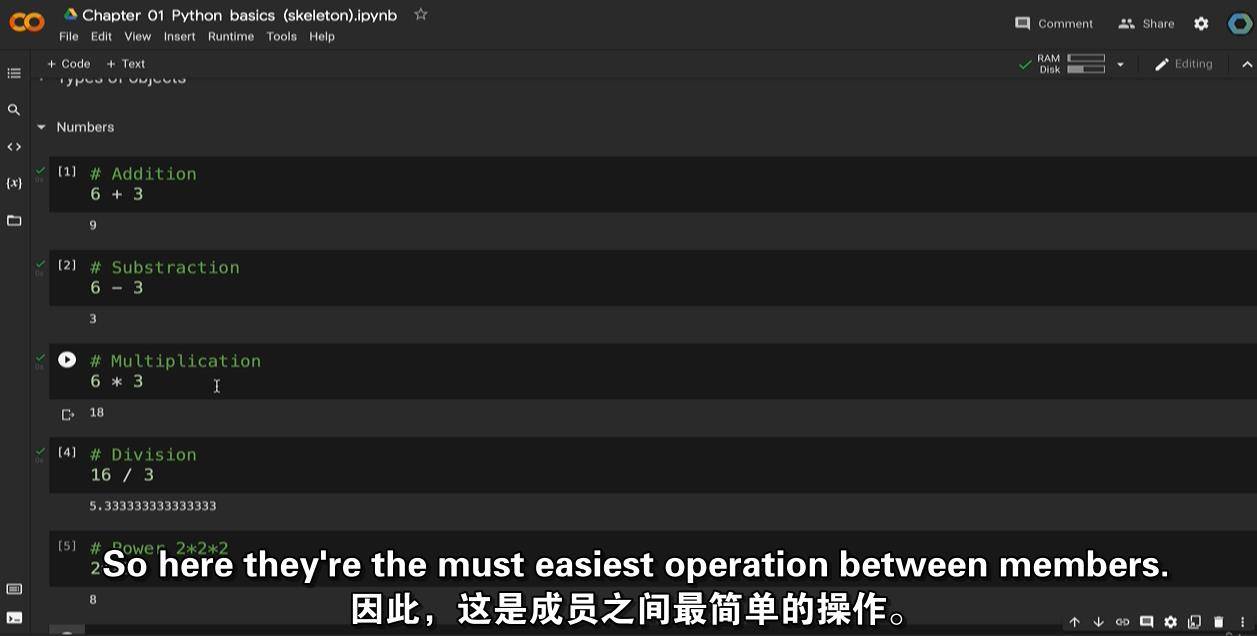

如果你至少回答了其中一个问题,我欢迎你参加这个课程。课程的所有应用都将使用Python来完成。但是,对于Python初学者来说,不要慌!有一个免费的python速成班包括掌握Python。

在本课程中,您将学习如何使用技术分析、价格行为、机器学习来创建稳健的策略。您将执行定量分析以发现数据中的模式。一旦你有了很多有利可图的策略,我们将学习如何进行向量化回溯测试。然后,你将应用投资组合技术来减少提取和最大化你的回报。

你将学习和理解投资组合经理和专业交易者使用的定量分析

建模:技术分析(均线,RSI),价格作用(支撑,阻力),机器学习(线性回归)。

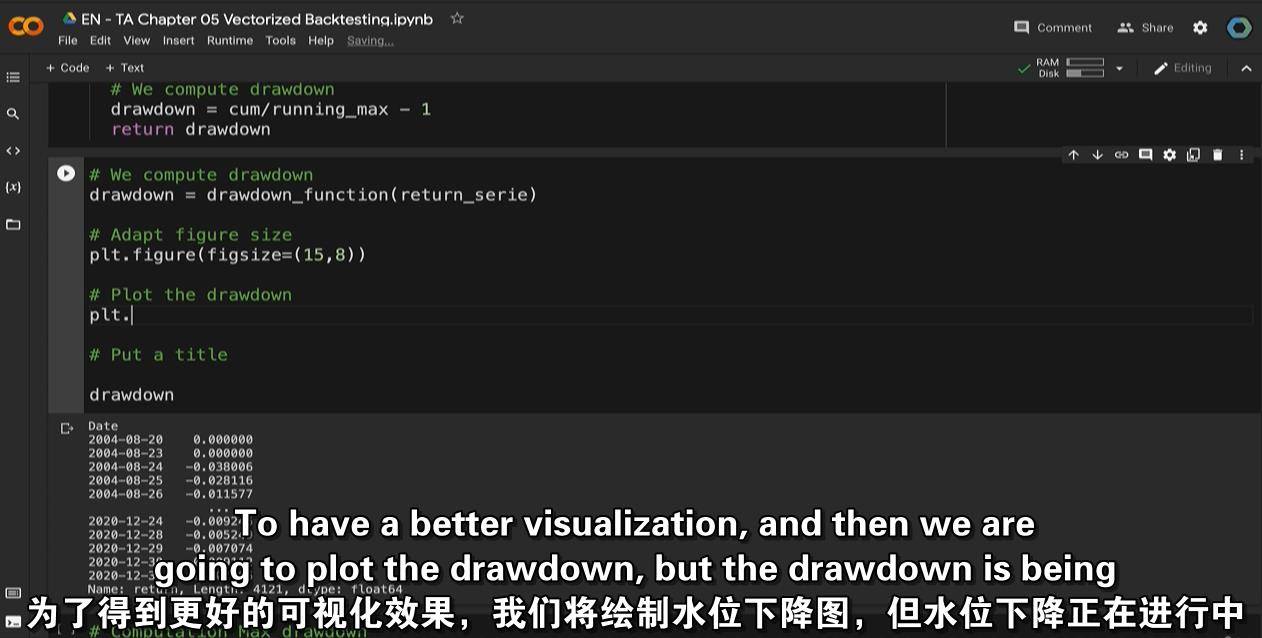

回溯测试:正确无误地进行回溯测试,并最小化计算时间(矢量化回溯测试)。

投资组合管理:恰当地组合策略(策略投资组合)。

为什么是这门课而不是另一门?

这不是编程课程,也不是交易课程或机器学习课程。这是一门运用统计学、程序设计和金融理论进行交易的课程。

这门课程不是由数据科学家创建的,而是由数学和经济学学位创建的,专门研究数学在金融中的应用。

您可以通过注册我们的免费Discord论坛来提问或阅读我们的定量金融文章。

别忘了课程满意或退款30天。不要错过提高你对这一迷人学科的知识的机会。

这门课是给谁的

每个想学算法交易的人

MP4 | Video: h264, 1280×720 | Audio: AAC, 44.1 KHz, 2 Ch

Genre: eLearning | Language: English + srt | Duration: 79 lectures (6h 17m) | Size: 2.6 GB

Technical analysis, Machine Learning, Price Action, Backtest, MetaTrader 5 live trading.

What you’ll learn

?Create an algorithmic trading strategy from A to Z (data import to live trading)

?Put any algorithm in live trading using MetaTrader 5 and Python

?Data Cleaning using Pandas

?️Guided tour thought the main algorithmic trading strategy (Technical Analysis, Price action, Machine Learning)

?Manage financial data using Numpy, Pandas and Matplotlib

?Python programming for algorithmic trading

?Create scaling, intraday and swing trading strategies

? Import stock price from Yahoo Finance and from your broker

Requirements

Nothing

Description

Do you want to create algorithmic trading strategies?

You already have some trading knowledge and you want to learn about quantitative trading/finance?

You are simply a curious person who wants to get into this subject to monetize and diversify your knowledge?

If you answer at least one of these questions, I welcome you to this course. All the applications of the course will be done using Python. However, for beginners in Python, don’t panic! There is a FREE python crash course included to master Python.

In this course, you will learn how to use technical analysis, price action, machine learning to create robust strategies. You will perform quantitative analysis to find patterns in the data. Once you will have many profitable strategies, we will learn how to perform vectorized backtesting. Then you will apply portfolio techniques to reduce the drawdown and maximize your returns.

You will learn and understand quantitative analysis used by portfolio managers and professional traders

Modeling: Technical analysis (Moving average, RSI), price action (Support, resistance) and Machine Learning (Linear regression).

Backtesting: Do a backtest properly without error and minimize the computation time (Vectorized Backtesting).

Portfolio management: Combine strategies properly (Strategies portfolio).

Why this course and not another?

This is not a programming course nor a trading course or a machine learning course. It is a course in which statistics, programming and financial theory are used for trading.

This course is not created by a data scientist but by a degree in mathematics and economics specializing in mathematics applied to finance.

You can ask questions or read our quantitative finance articles simply by registering on our free Discord forum.

Without forgetting that the course is satisfied or refunded for 30 days. Don’t miss an opportunity to improve your knowledge of this fascinating subject.

Who this course is for

Everyone who wants to learn algorithmic trading

云桥CG资源站 为三维动画制作,游戏开发员、影视特效师等CG艺术家提供视频教程素材资源!

1、登录后,打赏30元成为VIP会员,全站资源免费获取!

2、资源默认为百度网盘链接,请用浏览器打开输入提取码不要有多余空格,如无法获取 请联系微信 yunqiaonet 补发。

3、分卷压缩包资源 需全部下载后解压第一个压缩包即可,下载过程不要强制中断 建议用winrar解压或360解压缩软件解压!

4、云桥CG资源站所发布资源仅供用户自学自用,用户需以学习为目的,按需下载,严禁批量采集搬运共享资源等行为,望知悉!!!

5、云桥CG资源站,感谢您的关注与支持!