使用ChatGPT掌握Python中的技术分析和算法交易,“使用ChatGPT和Python进行定量分析”课程是为那些对学习如何使用Python和ChatGPT分析他们的交易策略和回溯测试他们的交易想法感兴趣的人设计的。本课程提供了算法交易的实际介绍,包括定量分析和技术分析的基础。通过一步一步的方法,本课程教学生如何使用Python开发和实现交易策略。该课程从介绍Python编程、数据分析和可视化的基础开始,然后转移到更高级的主题,如统计建模、时间序列分析和机器学习。该课程还涵盖了流行的交易指标,如均线、布林线和相对强弱指标(RSI),并向学生展示了如何用Python实现这些指标以生成交易信号。此外,学生将学习如何使用Python库(如pandas、NumPy和塔利布)进行数据分析,以及如何回测他们的交易策略。Stock Market Data Analysis Using Chatgpt & Python

课程结束时,学生将对算法交易、回溯测试和Python编程语言有一个坚实的理解,使他们能够开发和实施自己的自动化交易策略。本课程非常适合对金融市场和交易概念有基本了解,并希望学习如何自动化交易策略的个人。一些以前的编程经验,最好是Python编程经验,会有所帮助,但不是必需的。

MP4 |视频:h264,1280×720 |语言:英语+中英文字幕(云桥CG资源站机译)|时长:3小时36分钟 含课程文件

你会学到什么

使用ChatGPT通过Python创建技术分析

了解各种技术指标及其在交易中的应用。

使用Python编程语言对交易策略进行回溯测试并评估绩效。

通过在真实市场条件下构建和测试交易算法获得实践经验。

要求

对金融市场和投资概念有基本的了解

熟悉Python等编程语言

基本数学概念的理解

熟悉数据分析和可视化工具,如Pandas,Numpy

课程概观

第一节:股票市场数据分析简介

第一讲简介

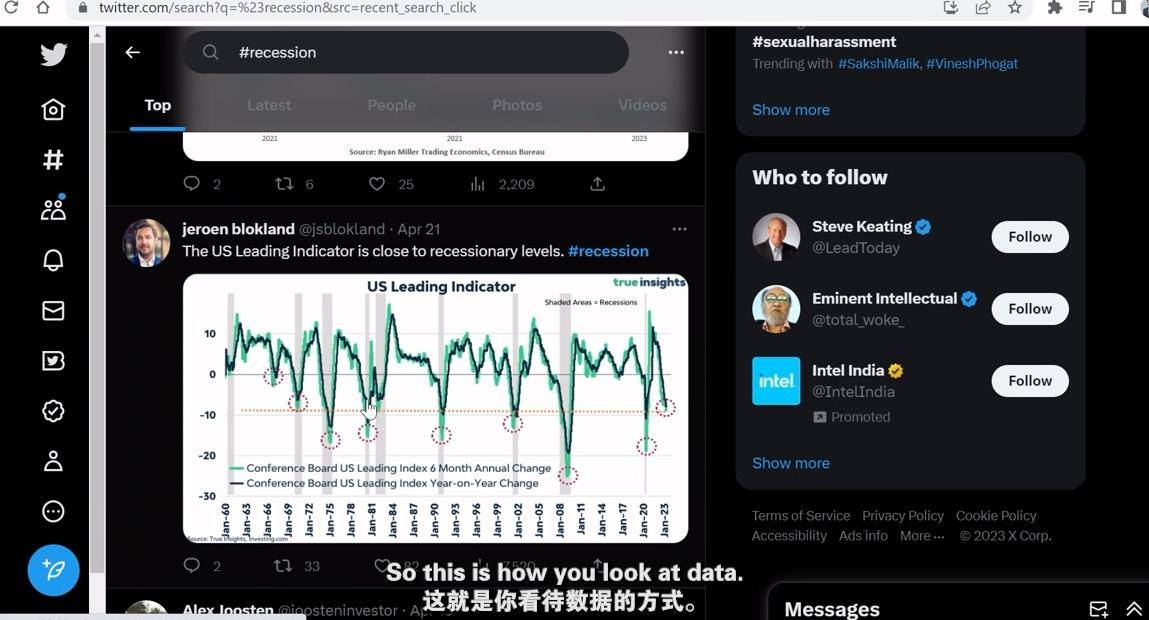

第2讲什么是股票市场&为什么数据分析对交易很重要

第三讲什么是ChatGPT,它如何用于股票市场数据分析

第4讲课程概述

第2节:使用ChatGPT进行数据收集、存储和准备

第5讲股票市场数据的不同来源概述

第6讲从不同来源(如API、CSV文件、网站)检索数据

第7讲从雅虎财经获取数据

第8讲从Alpha Vantage获取数据

第9讲从Quandl获取数据

第10讲从NSE收集数据(仅用于教育目的)

第11讲从纳斯达克收集数据(仅用于教育目的)

第12讲使用ChatGPT在MySQL数据库(可选)中存储数据

第3部分:技术指标和ChatGPT

第13讲了解技术指标的基本知识以及如何使用它们

第14讲使用ChatGPT的移动平均线

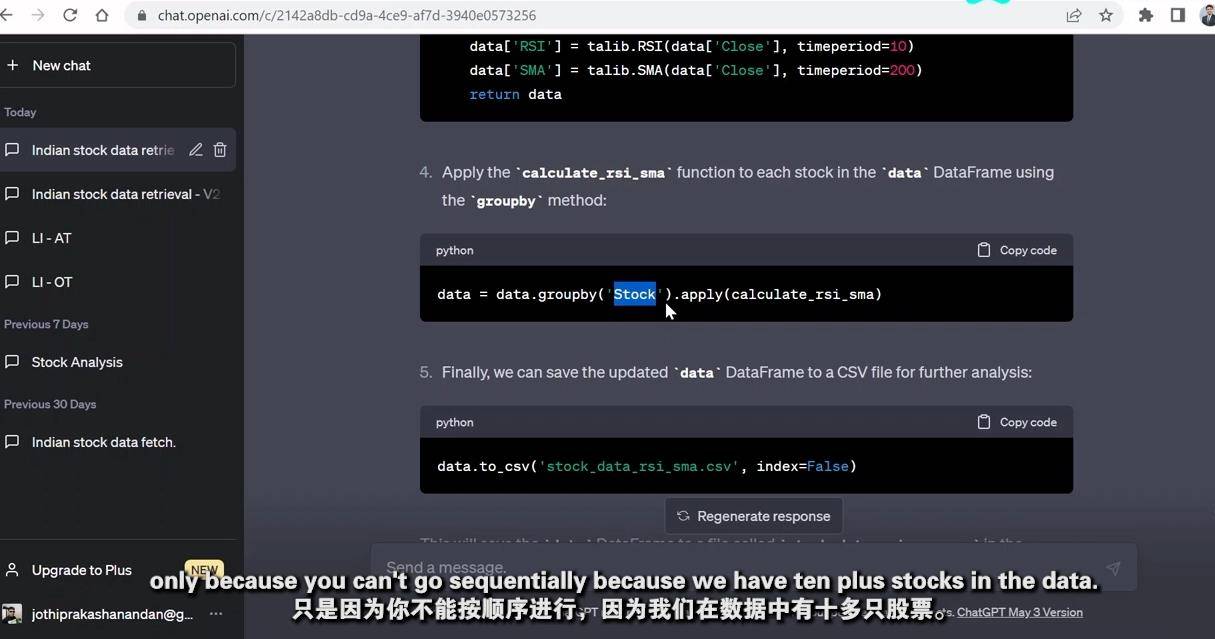

第15讲使用ChatGPT进行RSI

第16讲使用ChatGPT的布林线

第4部分:使用ChatGPT进行策略创建、回溯测试和性能测量

第17讲交易策略是如何产生的

第18课创建交易策略计划

第19讲创建交易策略

第20讲绩效评估

第5部分:后续步骤和结论

第21讲后续步骤和结论

任何对学习交易算法感兴趣的人,交易者,投资者,金融专家,以及希望获得算法交易实践经验的学生,Python程序员

Mastering Technical Analysis and Algorithmic Trading in Python using ChatGPT

What you’ll learn

Use ChatGPT to create technical analysis using Python

Understand various technical indicators and their applications in trading.

Backtest trading strategies and evaluate performance using Python programming language.

Gain practical experience by building and testing trading algorithms in real market conditions.

Requirements

Basic understanding of financial markets and investment concepts

Familiarity with programming languages like Python

Understanding of basic mathematical concepts

Familiarity with data analysis and visualization tools such as Pandas, Numpy

Description

The course “Quantitative Analysis using ChatGPT & Python” is designed for individuals interested in learning how to analyze their trading strategies and backtest their trading ideas using Python & ChatGPT. This course provides a practical introduction to algorithmic trading, including the basics of quantitative analysis and technical analysis.Through a step-by-step approach, this course teaches students how to develop and implement trading strategies using Python. The course starts by introducing the basics of Python programming, data analysis, and visualization, and then moves on to more advanced topics such as statistical modeling, time series analysis, and machine learning.The course also covers popular trading indicators, such as moving averages, Bollinger Bands, and Relative Strength Index (RSI), and shows students how to implement these indicators in Python to generate trading signals.In addition, students will learn how to use Python libraries such as pandas, NumPy, and Talib for data analysis and how to backtest their trading strategies.By the end of the course, students will have a solid understanding of algorithmic trading, backtesting, and the Python programming language, enabling them to develop and implement their own automated trading strategies.This course is ideal for individuals who have a basic understanding of financial markets and trading concepts and are looking to learn how to automate their trading strategies. Some prior programming experience, preferably in Python, would be helpful but is not required.

Overview

Section 1: Introduction to Stock Market Data Analysis

Lecture 1 Introduction

Lecture 2 What is the stock market & why data analysis is important for trading

Lecture 3 What is ChatGPT and how can it be used for stock market data analysis

Lecture 4 Overview of the course curriculum

Section 2: Data Collection, Storage and Preparation using ChatGPT

Lecture 5 Overview of different sources of stock market data

Lecture 6 Retrieving data from different sources (e.g. APIs, CSV files, websites)

Lecture 7 Fetching data from Yahoo Finance

Lecture 8 Fetching data from Alpha Vantage

Lecture 9 Fetching data from Quandl

Lecture 10 Scraping data from NSE (Educational purpose only)

Lecture 11 Scraping data from Nasdaq (Educational purpose only)

Lecture 12 Storing data in a MySQL database (optional) using ChatGPT

Section 3: Technical Indicators & ChatGPT

Lecture 13 Understanding the basics of technical indicators and how they are used

Lecture 14 Moving Average using ChatGPT

Lecture 15 RSI using ChatGPT

Lecture 16 Bollinger Bands using ChatGPT

Section 4: Strategy Creation & Backtesting & Performance Measurement using ChatGPT

Lecture 17 How a trading strategy is created

Lecture 18 Creating a Trading Strategy Plan

Lecture 19 Creating the Trading Strategy

Lecture 20 Performance Measurement

Section 5: Next Steps & Conclusion

Lecture 21 Next Steps & Conclusion

Anyone interested in learning about trading algorithms,Traders, Investors, Finance professionals, and students looking to gain hands-on experience in algorithmic trading,Python programmers

1、登录后,打赏30元成为VIP会员,全站资源免费获取!

2、资源默认为百度网盘链接,请用浏览器打开输入提取码不要有多余空格,如无法获取 请联系微信 yunqiaonet 补发。

3、分卷压缩包资源 需全部下载后解压第一个压缩包即可,下载过程不要强制中断 建议用winrar解压或360解压缩软件解压!

4、云桥CG资源站所发布资源仅供用户自学自用,用户需以学习为目的,按需下载,严禁批量采集搬运共享资源等行为,望知悉!!!

5、云桥CG资源站,感谢您的赞赏与支持!平台所收取打赏费用仅作为平台服务器租赁及人员维护资金 费用不为素材本身费用,望理解知悉!